Tags: Terra Ust

Decentralized Finance in the Terra Ecosystem

Here's something I don't write about normally; I've figured that taking a break from writing my usual stuff would be a nice change-of-pace :)

What is Terra network?

Terra is a public permisionless blockchain providing a number of algorithmic stablecoins pegged to currencies like the US Dollar. Handling Terra USD (UST) is just like handling the equivalent amount of USD; 1 UST = 1 USD, and this dollar-peg is supported by the mechanics of the Terra network. If you're further curious about how Terra achieves this peg you may find this video helpful.

There are many other stablecoins pegged to the US dollar outside of the Terra ecosystem like USDC and Tether USD but both of these are only backed by promises; neither of these are algorithmic stablecoins. USDC and USDT rely on reserves held by the minter of the tokens to back the circulating supply one-to-one. Terra's USD is currently the fifth-largest stablecoin in circulation and one of the few algorithmic stablecoins available today. The Terra ecosystem offers many other stablecoins pegged to other national currencies like the Korean Won and Japanese Yen but Terra USD is the anchor of the Terra ecosystem.

Generally the benefit of stablecoins is that they are digitally transferrable, unlike paper-money, and self-custodied, unlike money in a bank account.

Is Terra Network Safe?

Yes; of course I encourage you to always do your own research (`・ω・´)”. Today I only want to expose you to something you may not be familiar with, especially if you've never heard of stablecoins or decentralized finance in general. This is not financial advice in any capacity.

What can Terra ecosystem do for me that I can't already do on my own?

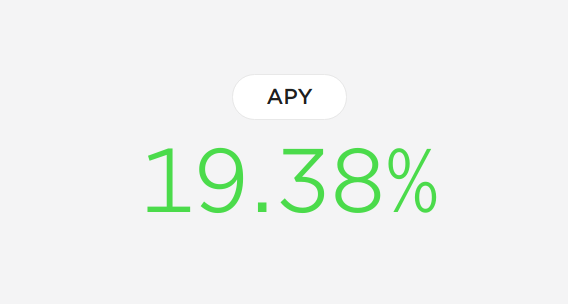

One of the biggest and most exciting projects on Terra is Anchor. Anchor is a place where you can deposit UST and earn yield close to a fixed 20% APY. Anchor provides this yield by using your deposit to stake in other blockchains. Your deposit also provides capital to people willing to borrowing on Anchor with an overcollateralized loan. You can withdraw your principal + interest at any time.

This is exactly how a bank uses capital in members' accounts (see: Money Market Model). Here however Anchor provides a superior yield because its smart-contracts use captial far more effectively than a traditional bank can. As an example, the high-yield savings account at my State Employee's Credit Union has a 0.15% APY. Additionally I can only touch this account 8 times a month. In contrast the capital I put into Anchor yields over 133x that APY; this is almost a laughable difference.

A $1000 deposit into a 20% APY account compounding monthly grows to $1219.39 over 12 months; the same deposit into a 0.15% APY account is $1001.50. The thought of earning $1.50 over an entire year sounds like a joke, yet this is all the interest that traditional banking affords.

Furthermore your deposit on Anchor is entirely in UST; it is not exposed to the volatility of the cryptocurrency market-cycle. UST is only as risky as the USD-UST peg. Remember: 1 UST = 1 USD give-or-take fractions of a penny o(〃^▽^〃)o (still unsure? check the USD-UST historic price (it's 1:1)).

Only 20% APY?

You may be wondering: an extra $219.30 per $1000 per year is nice, but I could get more by gambling on shitcoins! You're right here; but remember that UST is not an investment. It is a stablecoin. (1) You can withdraw at any time, (2) your deposit is in a USD-pegged stablecoin so (3) you have no exposure to the cryptocurrency market.

Depositing UST is the lowest-risk investment strategy on Terra ecosystem. There are many more strategies involving varying degrees of risk in the pool of possible portfolios. Many are grouped under the broad category of yield farming.

Just Getting Started

If you're still curious and want to self-custody your own money on Terra I'll provide a small walkthrough on how to use Terra ecosystem and Anchor below. You can run the tutorial backwards to get your money out of the Terra ecosystem as well, but remember to report your earned interest to the IRS if / when you choose to exit Terra :)

On-ramps to the Terra Ecosystem

I live in the US. My on-ramp to the crypto ecosystem in general is Coinbase because I can link directly with my bank account.

Update: ERC-20 LUNA (wLUNA) and ERC-20 UST are listed on Coinbase! Follow these steps but use wrapped UST or wrapped LUNA in place of wrapped Mirror tokens (I wrote this article on the day UST support was announced lol)

... I assume here that you're familiar with cryptocurrency wallets. You'll need a Terra wallet (I use TerraStation for Chrome) and an Ethereum wallet (I use MetaMask for Chrome as well). I am a Firefox-fanboy at heart but I use Chrome almost exclusively for my hot crypto wallets for this reason.

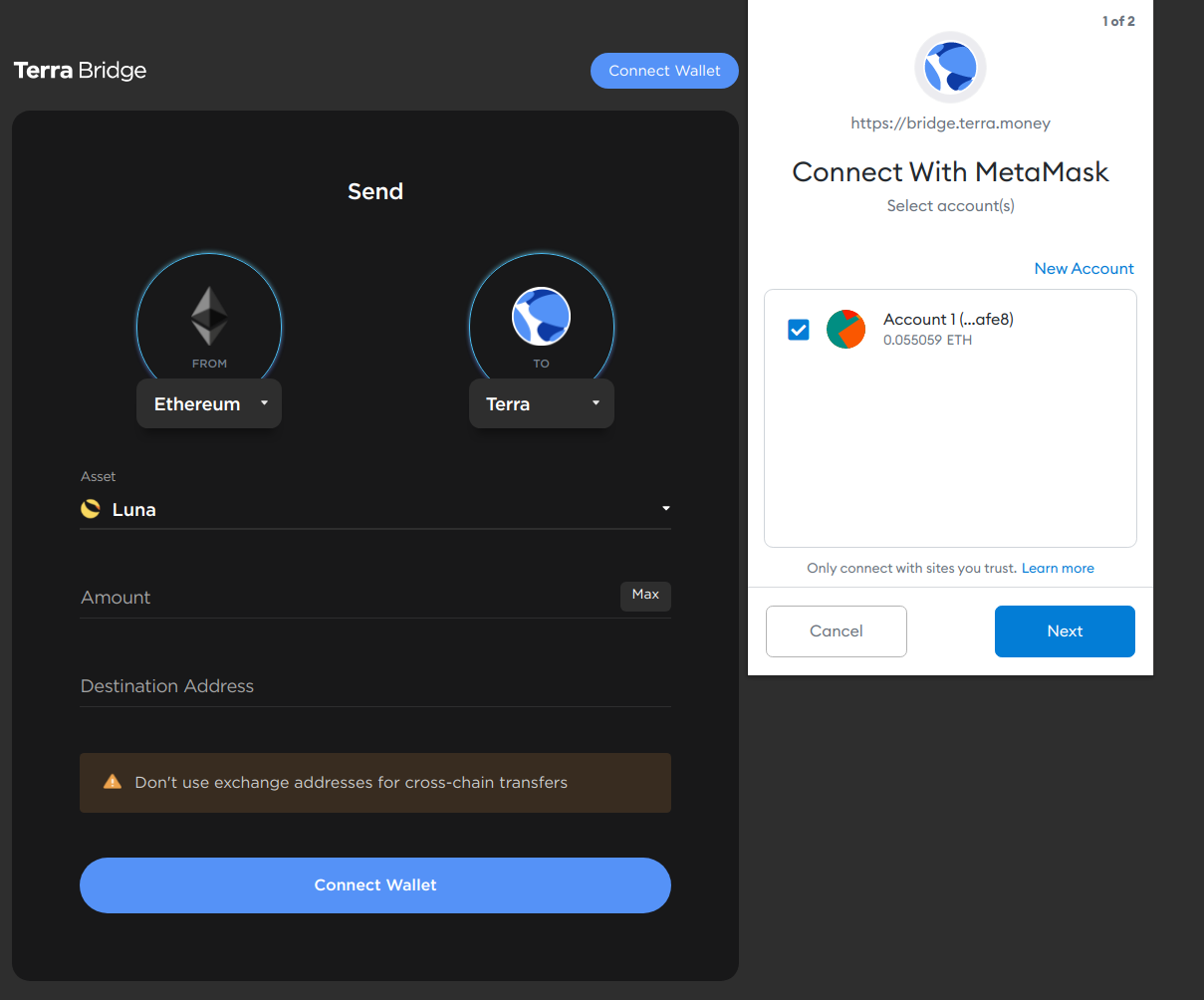

Once you've got these two wallets installed you can begin to move capital from the exchange of your choice into the Terra ecosystem. Because it is listed on Coinbase I prefer to move funds into Terra via the ERC-20 Mirror token (MIR). Mirror is a native asset on the Terra blockchain and a version of it is sold on Coinbase. Coinbase sells the "wrapped" Ethereum version (ERC-20 version) of the token. To "unwrap" these ERC-20 "wrapped" tokens you need to use the Terra bridge. The bridge supports transfers from the Ethereum, BSC and Harmony blockchains; I know that a Solana integration is coming very soon as well.

After you buy ERC-20 MIR tokens on Coinbase and withdraw it to your own Ethereum / MetaMask wallet you can swap it on the Terra bridge for native MIR tokens which are deposited to your TerraStation wallet. With the native MIR token you can swap those on TerraSwap for UST.

... quite a complex process |・ω・`) For reference I use the following workflow to on-ramp to the Terra network:

- Deposit USD onto Coinbase using my linked bank account

- Buy ERC-20 Mirror (MIR) with the deposited USD

- Withdraw

the purchased ERC-20 MIR to my own, self-custodied Ethereum wallet (I use

MetaMask for this)

- On Coinbase I need to wait a few days for the initial bank transfer to clear

- Swap the ERC-20 MIR in my Ethereum wallet for native MIR (deposited to my Terra wallet) via the Terra bridge.

- Exchange my native MIR tokens for UST on Terraswap.

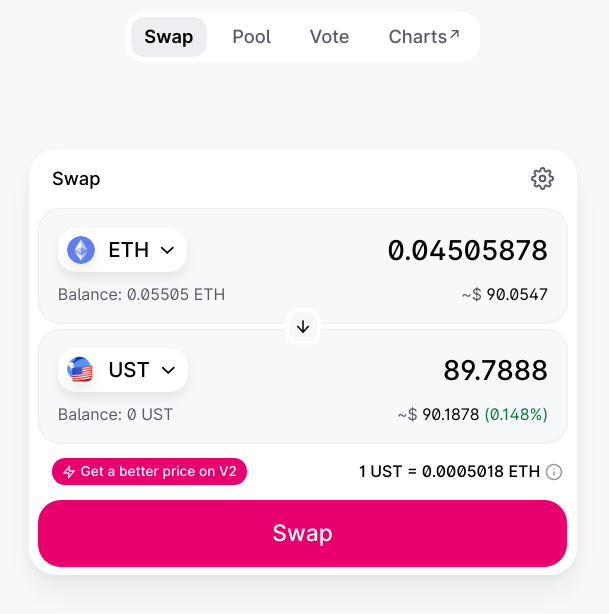

... if your exchange doesn't offer ERC-20 MIR you may need to buy Ethereum and use Uniswap to exchange Ethereum for ERC-20 UST. Here's how I go from Ethereum to Terra-native UST.

This can then be converted to native UST with the same Terra bridge as above.

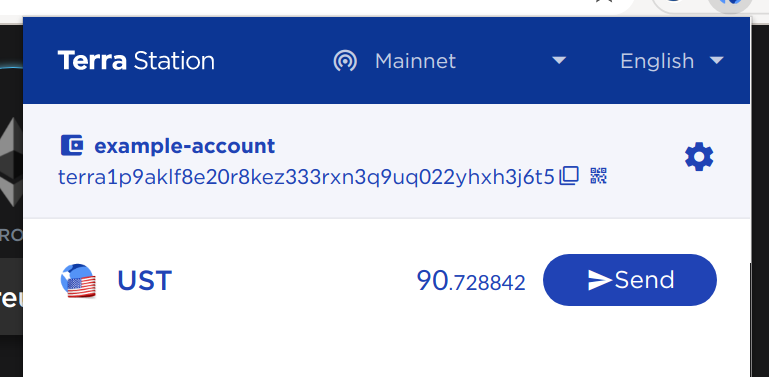

... after you exchange ERC-20 UST for native UST you should see it in your Terra wallet!

After completing step (3) your money is entirely self-custodied ヽ(*≧ω≦)ノ... this is one of my favorite features about cryptocurrency in general! It means I have instant and unfiltered access to my own money.

Remember that from here on it is your own responsibility to safeguard the private keys to your own wallet; this can be scary at first but the freedom it permits is unmatched by anything else in legacy finance: I can do anything with this money because it is mine and nobody has any say otherwise. Also, all transactions on the Terra network are processed in mere seconds. In contrast my bank may take several days to settle payments from my own account.

Deposit to Anchor

With the UST deposited into your wallet it is trivial to deposit this to Anchor and to realize your 20% APY. Simply use the Anchor dApp to deposit UST.

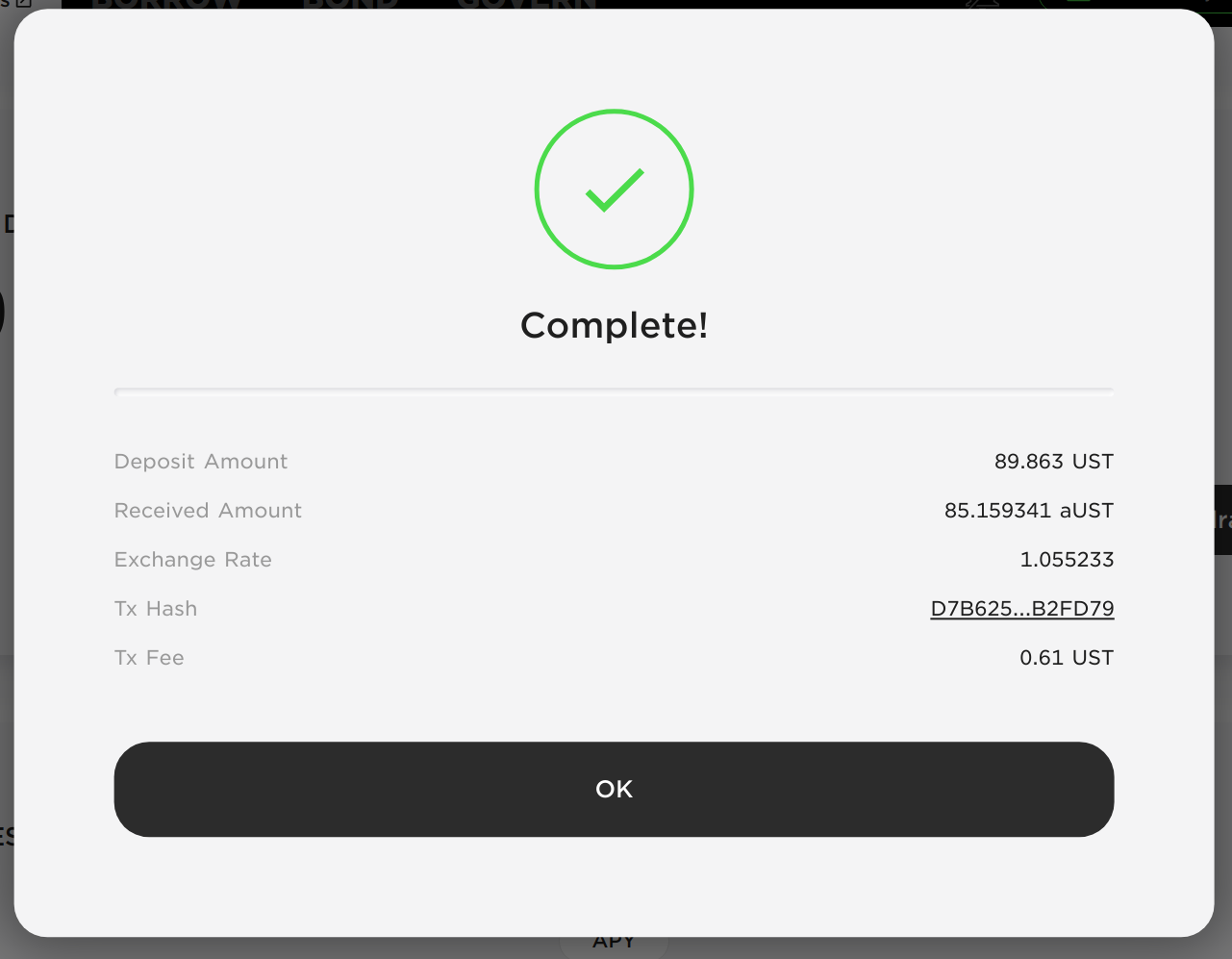

After deposit you will receive an amount of aUST (see above) which represents your deposit. This aUST appreciates with time according to a constant rate; when you do choose to withdraw your UST it will have appreciated with roughly 20% APY. The current APY is listed on the front page.

Other Opportunities in the Terra Economy

There are many opportunities to farm yields in the Terra ecosystem. These often produce far more than 20% APR, however many tactics will assume a certain tolerance for risk. Using Mirror you could realize excess of a 40% yield while assuming only USD-UST risk.

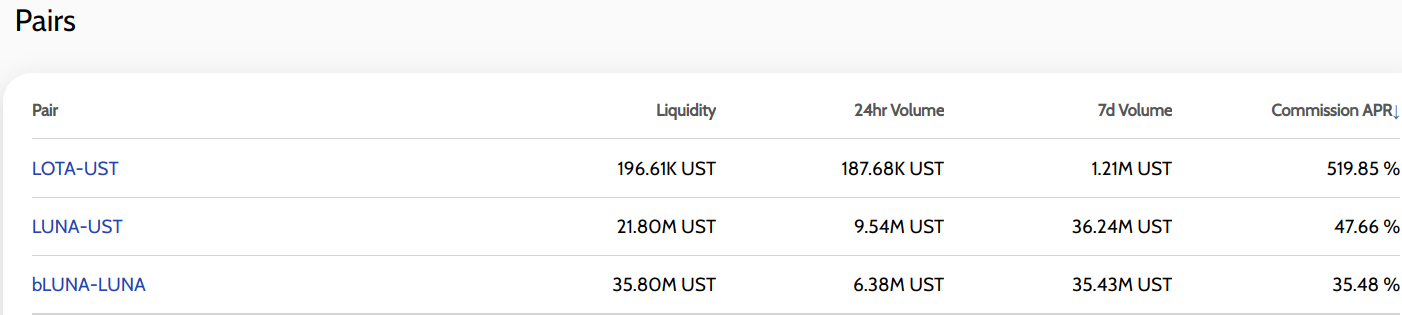

By providing liquidity on Terraswap, Terra's front-running DEX, you could realize quite pleasant APRs as well.

Providing liquidity of course comes with the possibility of impermanent loss so make sure you understand the risks!

Opportunities with High-volatility Assets on Terra

If you can assume more short-term risk than just holding stablecoins you may choose to buy-and-hold LUNA, the Terra asset which absorbs market volatility to help UST maintain its dollar-peg. If you choose to hold LUNA I'd advise you stake it with a trusted validator to increase your LUNA holdings and to receive Terra ecosystem airdrops. Unlike Anchor deposits, LUNA stakers are rewarded with LUNA and Terra ecosystem airdrops.

Finally, the highest opportunity of risk-to-reward is betting on the new projects building on the Terra network that launch on Terra's Pylon launchpad. If your investments here pay off you may find yourself with more UST than you know what to do with... in that case, stake stake stake!

Redeem Your Principal + Yield

If you choose to withdraw from Terra instead of investing your yield then you can simply reverse this workflow! Remember that cashing out is a taxable event (at least here in the US (`・ω・´)”) so make sure you at least understand the reporting implications of moving money back into your bank account.

Stay safe and have fun!

- Last Modified

- First Written

Related / Browse

- May-21

-

Words

U

May 21, 2015

- Everything in Its Right Place

-

Year

World

February 19, 2020

- April-14

-

Cannot

Year

April 14, 2016

- June-01

-

Club

College

June 1, 2015

- Favorite Songs from All DDR Ever

-

Ddr

Mix

June 9, 2018

- nov_undated1

-

Yesterday

Week

November 1, 2016

- August-29

-

Text

Sunday

August 29, 2015